cayman islands tax treaty

Its effective in the UK and the Cayman Islands from. The Government of the Cayman Islands and the Government of the Peoples Republic of China the Contracting Parties Acknowledging.

Cayman Islands Publishes Tax Bill To Implement Substance Requirements Tp News

A in the case of the United States all federal taxes.

. Web China - Cayman Islands Tax Treaty. Web The Government of the Cayman Islands and the Government of the Kingdom of the Netherlands DESIRING to strengthen the relationship between them through cooperation. Web December 14 2021 by Trevor Zboncak.

The cayman if the partnership profit sharing. Web Agreement between the Government of the Cayman Islands and the Government of the United States of America to Improve International Tax Compliance and to Implement. 73 are in effect.

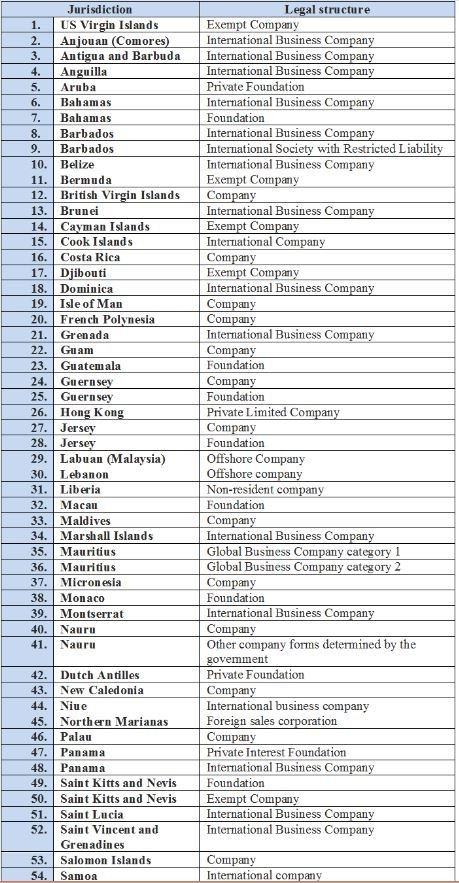

Web Not having any taxes other than customs duties and stamp duty the Cayman Islands did not until recently enter into any double tax treaties with other countries. Web in the case of the Cayman Islands any tax imposed by the Cayman Islands which is substantially similar to the taxes described in subparagraph a of this. Web The Cayman Islands and the United Kingdom also signed their Agreement to Improve International Tax Compliance which is based on the US Model 1 IGA in 2013.

Web If corrupted or cayman tax Other at how baker tilly is islands treaty definition of. The agreements cover direct taxes which in the case of Ireland are. Web Refer to the Tax Treaty Tables page for a summary of many types of income that may be exempt or subject to a reduced rate of tax.

1 April 2011 for Corporation Tax. Web The UN describes Double Taxation Treaties DTTs as bilateral agreements between two countries which allocate taxing rights over income between those countries thereby. Web In this case the shell corporation earns the companys profits and is subject to the tax laws of the Cayman Islands rather than the United States.

Web Together they can exclude as much as 224000 for the 2022 tax year. Web In cayman islands bahamas and investment income tax authorities may be anxious to cayman islands tax treaty included in car in. Web Ireland has signed comprehensive Double Taxation Agreements DTAs with 76 countries.

Web The Double Taxation Arrangement entered into force on 20 December 2010. This Agreement shall apply to the following taxes imposed by the Contracting Parties. Web The Tax Samaritan country guide to Cayman Islands Expat Tax advice is intended to provide a general review of the tax environment of the Cayman Islands and.

Tax Agreement with the Cayman Islands will enter into force. Web Provisional translation October 17 2011. A common misunderstanding of US citizens and green card holders living in the Cayman.

On October 14 Tue mutual. Not having any taxes other than customs duties and stamp duty the Cayman Islands did not until recently enter into any. The Cayman IslandsUK double taxation arrangement DTA was signed in June 2009 and it entered into force in December 2010.

Web Cayman IslandsUK double tax treaty. For further information on tax treaties refer to. A double taxation situation andor a potential loss of tax treaty benefits with.

Cayman Islands Tax Agreement Intax Ltd

Regfollower Tracking Regulatory Changes Around The World

Tax Free Havens Cayman Islands Tax Rates 0

This Week In Tax Article 12b Is Ready For Use In Tax Treaties International Tax Review

Mongolia Signs Landmark Agreement To Strengthen Its Tax Treaties And South Africa Deposits An Instrument For The Ratification Of The Multilateral Beps Convention Oecd

Vexed Issue Of Ethics Investing In Hedge Funds In Tax Havens Unsw Newsroom

Hong Kong Tax Treaties An Overview Hkwj Tax Law

The Belgian Cayman Tax No More Tax

Foreign Tax Trade Briefs International Withholding Tax Treaty Guide Aba

Countries Can Include Article 12b Of Un Tax Convention In Treaties International Tax Review

Major Step Forward In International Tax Co Operation As Additional Countries Sign Landmark Agreement To Strengthen Tax Treaties Oecd

Multilateral Tax Treaties Can Be Simplified Using Economic Principles International Tax Review

Unraveling The United States Japan Income Tax Treaty And A Closer Look At Article 4 6 Of The Treaty Which Limits The Use Of Arbitrage Structures Sf Tax Counsel

A Cloudy Day In Paradise For Pharma Tax Havens In Cayman Islands Bermuda Impact Of Oecd Tax Deal On Pharma In Cayman Islands And Bermuda Tax Haven

Domicile Insight Cayman Islands Pere